Contents

Introduction:

Credit scores are the cornerstone of individuals’ financial lives, shaping their ability to secure loans, attain favorable interest rates, and access a spectrum of financial services. A grasp of credit scores and their implications is vital for those navigating the realms of borrowing and lending. In this extensive handbook, we’ll demystify the intricacies of credit scores, delve into their role in loan approval, and offer insights for managing and enhancing your creditworthiness.

Understanding Credit Scores:

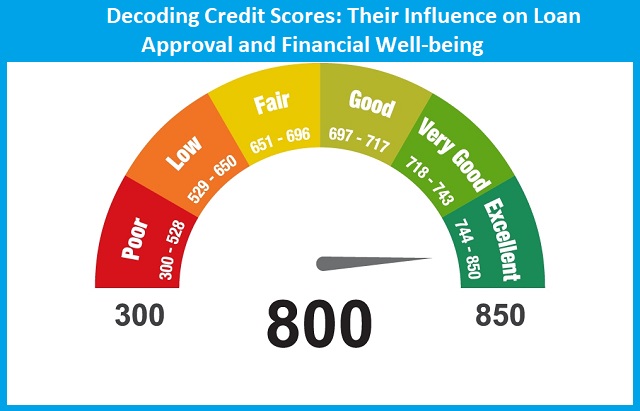

A credit score serves as a numerical gauge of an individual’s creditworthiness, reflecting their credit history and financial conduct. Typically ranging from 300 to 850, higher scores signify lower risk for loan default and higher creditworthiness. These scores derive from data in credit reports, encompassing details about an individual’s credit accounts, payment patterns, outstanding debts, and related factors.

Factors Influencing Credit Scores:

Various factors contribute to shaping an individual’s credit score, including:

Payment History: The foremost factor, constituting roughly 35% of the score, evaluates whether borrowers have consistently made timely payments on credit accounts like cards, loans, and mortgages. Late payments or defaults can dent credit scores.

Credit Utilization: This measures the percentage of available credit a borrower uses. High utilization, such as maxing out credit cards, signals financial strain and can negatively affect scores. Experts advise keeping utilization below 30% for healthy scores.

Length of Credit History: Accounting for about 15% of credit scores, lenders favor lengthier credit histories as they offer more data for assessing creditworthiness. Established credit histories generally yield higher scores.

Credit Mix: Lenders consider the variety of credit accounts individuals manage, such as cards, loans, and mortgages. A diverse mix can positively impact scores, reflecting responsible credit handling. However, opening multiple accounts swiftly can have adverse effects.

New Credit Inquiries: When individuals seek new credit, lenders conduct hard inquiries on their reports. Numerous inquiries in a short span raise red flags for lenders and lower credit scores. It’s crucial to minimize unnecessary credit applications.

The Impact of Credit Scores on Loan Approval:

Credit scores wield considerable influence over loan eligibility and terms. Lenders utilize them to gauge lending risk and determine interest rates, loan sizes, and repayment conditions. Higher scores typically yield lower interest rates, larger loan amounts, and more favorable terms, whereas lower scores may result in the opposite.

For instance:

Mortgage Loans: Higher credit scores translate to better mortgage prospects, with lower rates and down payment requirements, making homeownership more accessible.

Auto Loans: Elevated credit scores enhance chances of auto loan approval at lower rates, reducing overall vehicle purchase costs.

Personal Loans: Strong credit scores increase likelihood of personal loan approval with preferable rates and higher borrowing limits, catering to diverse financial needs.

Credit Cards: Better scores often lead to access to credit cards with lower rates, higher limits, and appealing rewards programs.

Tips for Managing and Enhancing Credit Scores:

Maintaining robust credit scores is paramount for favorable loan terms and financial objectives. Consider these strategies:

Punctual Payments: Timely bill settlements across credit accounts build positive payment histories and avert penalties.

Low Credit Utilization: Keeping credit card balances well below limits showcases responsible credit management.

Regular Monitoring: Periodic scrutiny of credit reports from major bureaus helps detect errors, inaccuracies, or fraud that might impact scores.

Minimal New Inquiries: Limiting new credit applications mitigates the risk of score reduction due to multiple hard inquiries.

Diversified Credit Mix: Balancing various credit accounts demonstrates prudent credit management, fostering score improvement over time.

Conclusion:

Credit scores serve as vital barometers of creditworthiness, wielding significant influence over loan approval and financial access. Understanding the determinants of credit scores and their ramifications for loan approval is pivotal for effective personal finance management and goal achievement. By embracing responsible credit practices, vigilantly monitoring credit reports, and proactively enhancing credit scores, individuals can fortify their financial well-being and unlock more favorable loan terms. Remember, cultivating and sustaining healthy credit demands patience and discipline, but the dividends of improved loan conditions and financial stability are well worth the dedication.